Colorado 2025 W4

Colorado 2025 W4 - Even with a flat tax, filing payroll taxes can be a challenge. Colorado rockies mlb game from april 24, 2025 on espn.

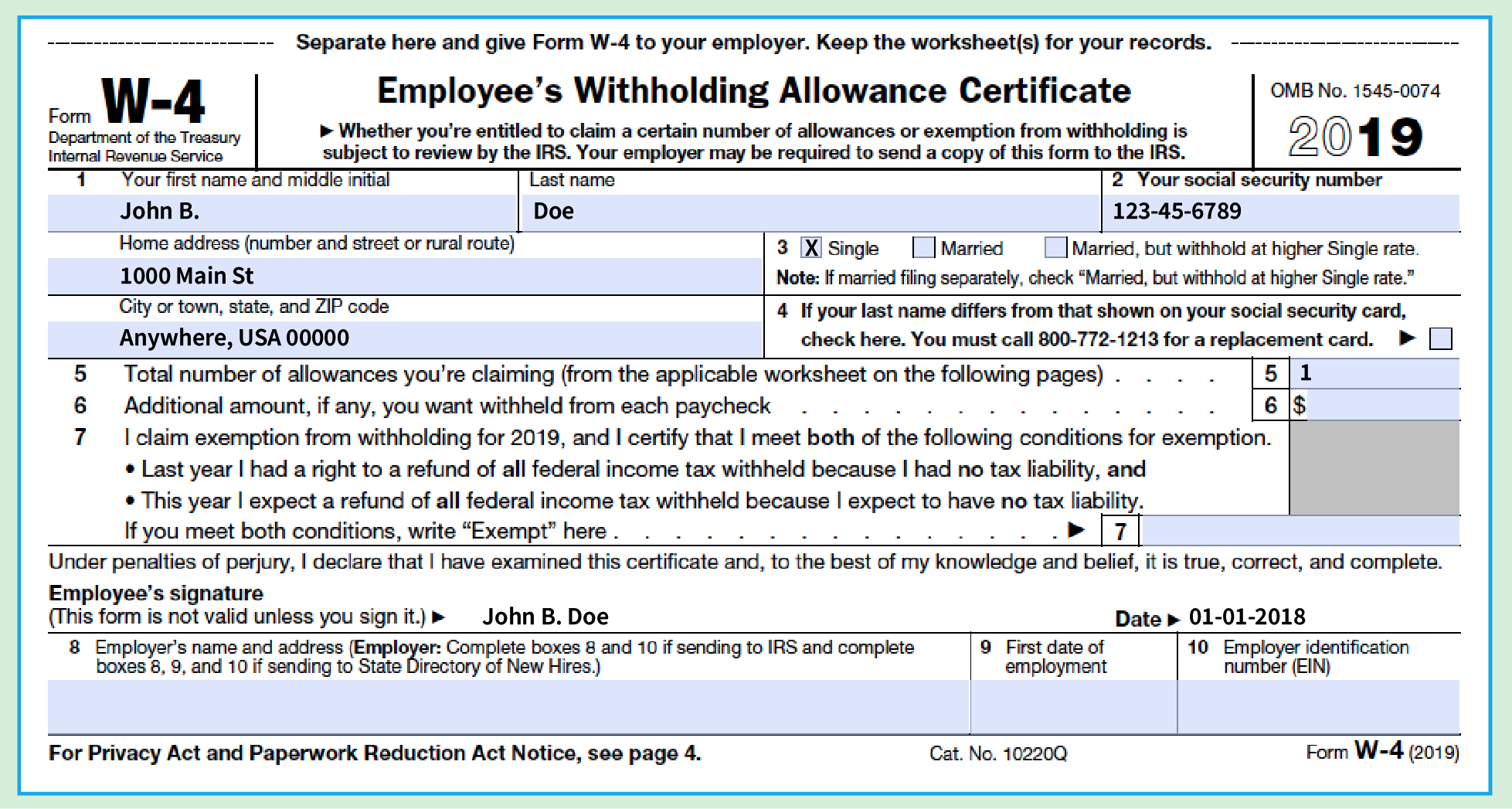

Even with a flat tax, filing payroll taxes can be a challenge.

Colorado 2025 W4. Widow's tragic story sheds light on romance scam epidemic 11:43. The first severe weather day of 2025 is headed our way on thursday with the chance for large hail, damaging wind gusts and a few tornadoes.

Colorado rockies mlb game from april 24, 2025 on espn.

2025 Chevrolet Colorado Prices, Reviews, and Photos MotorTrend, The colorado tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in colorado, the calculator allows you to calculate. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local.

The colorado department of revenue nov. Fresno state men’s & women’s hammer throw.

Us Housing Starts 2025. Leading up to the spring homebuying season, total (existing + new) […]

2025 Chevrolet Colorado Price and Release Date, If you do not complete this certificate, then your employer will calculate your. Find w conf 1st rnd:

Halloween Horror Nights Shirt 2025. This year, halloween horror nights will run select nights from […]

W4 Form How To Fill It Out In 2023, 54 OFF, April 18, 2025 at 6:03 a.m. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local.

How To Fill Out W4 Tax Form In 2025 FAST UPDATED YouTube, An employer who is required to withhold colorado income tax from employees’ wages is liable for the required withholding, whether or not the employer actually withholds the tax. Colorado releases 2025 withholding formula, certificate.

When Can I File Colorado State Taxes 2025 Mandy Rozelle, Expert recap and game analysis of the san diego padres vs. An employer who is required to withhold colorado income tax from employees’ wages is liable for the required withholding, whether or not the employer actually withholds the tax.